Accounts Receivable

Introduction

The Accounts Receivable (AR) module is an essential accounting component, enabling users to efficiently manage customer information, automate invoicing, streamline payment processing, improve cash flow management, and enhance financial reporting.

Set Up Accounts Receivable

To set up the AR module and the General Ledger Accounts, please watch the 1ERP Initial Setup video. It is recommended to set up the AR Journal accounts before using the AR system.

Processes in AR System

Invoice Customer

The "Invoice Customer" screen provides the functionality to automatically and manually generate invoices.

By leveraging features within the "Customer Payment" screen, you can effectively manage payments, track prepayments, and maintain accurate record of customer transactions.

Automatic

From Subsystems: Receive invoices automatically from subsystems such as HR Management. This integration ensures that invoices are generated and captured seamlessly from relevant processes within the system.

Recurring Entry: Generate and track recurring invoices through the "Recurring Invoice" screen. This feature enables the system to create periodic invoices based on predefined schedules, reducing manual effort and generating accurate invoices for recurring services or products.

Manual Entry

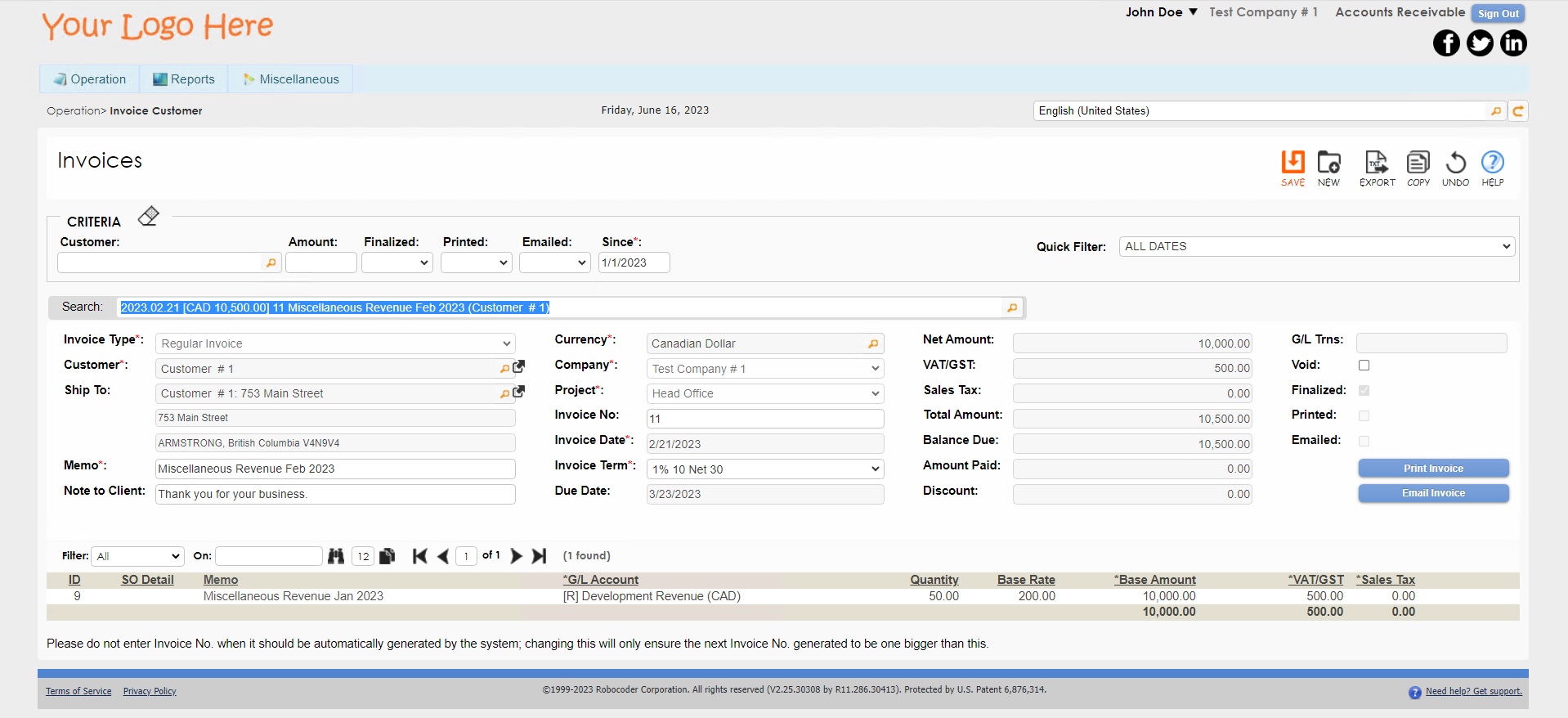

Enter invoices manually on an ad-hoc basis. This option allows for the flexibility to handle unique or one-time invoicing scenarios that may not be captured through the automated processes. A sample invoice from the AR system is shown for reference:

When entering the invoice information, it is highly recommended to import the original or imaged invoice. This practice facilitates easy reference and provides necessary documentation for audits and when addressing inquiries related to the invoice. By maintaining a comprehensive record of invoices, including the original or imaged invoice, organizations can enhance transparency, compliance, and overall financial management.

Create Payments for Invoices

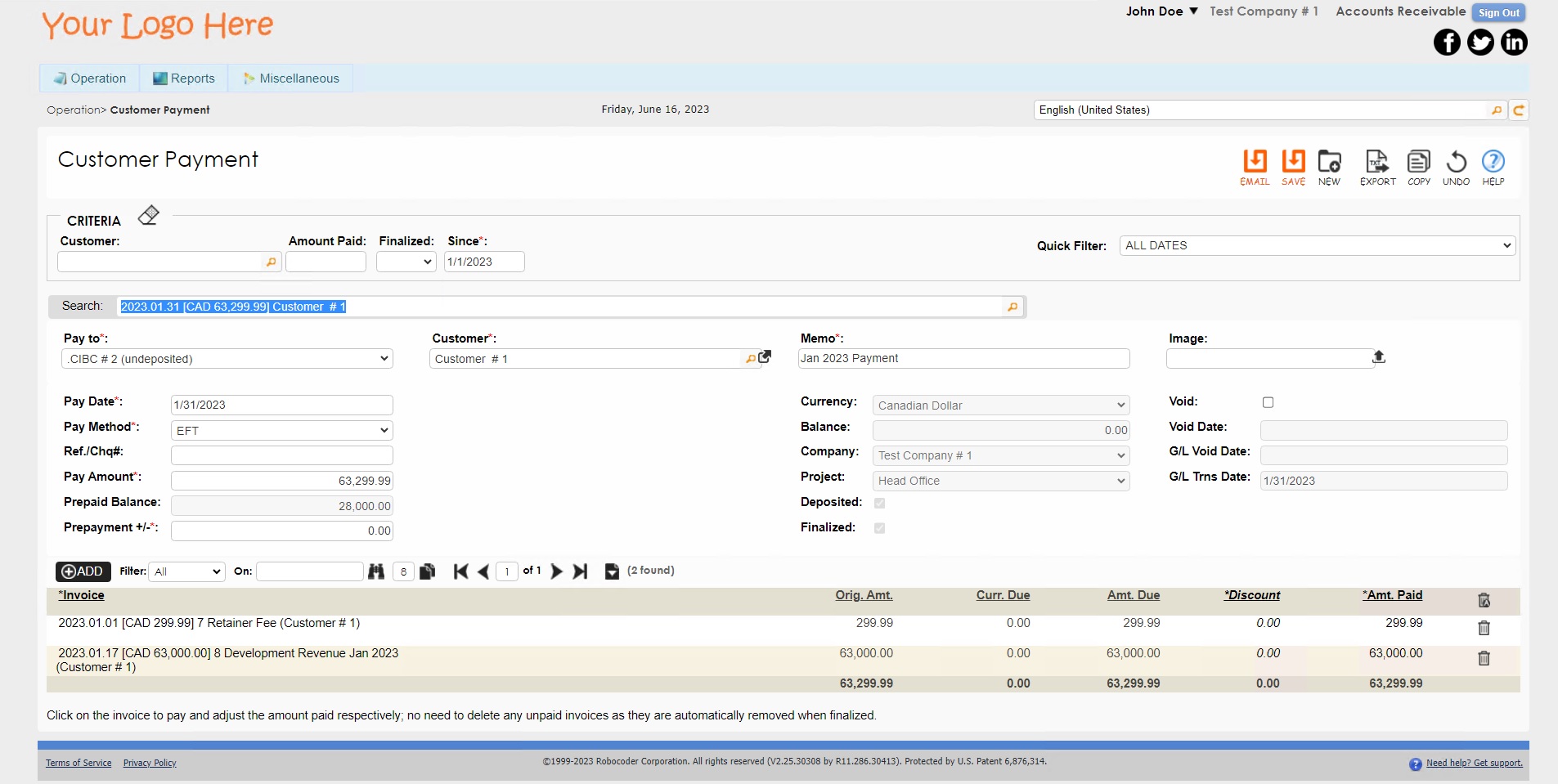

Once an invoice is entered and finalized, a corresponding record will appear in the "Customer Payment" screen. In this screen, you have the option to make partial payments for a single invoice or cover multiple invoices with a single payment.

Pay in Full and in Partial

-

Select the desired bank account in the "Pay To" field and the desired customer in the "Customer" field.

-

Enter in the desired amount in the "Pay Amount" field. To pay in full, enter in the full invoice amount. To pay in partial, enter in the desired pay amount.

-

Click on Save to create payments for the selected invoices.

Prepayment for an Invoice

To enter a prepayment received from a customer without an associated invoice, press the "NEW" button on this screen and enter the details of the prepayment. The prepaid balance for the customer will be updated and displayed every time the customer is selected.

Collection Agent

The Collection Agent Screen serves as a valuable tool for monitoring late invoices and facilitating effective communication with customers. Its primary purpose is to assist in the collection process and maintain comprehensive records of interactions related to overdue invoices.

With the Collection Agent Screen, users can easily track and manage late invoices to enable timely follow-up and payment resolution. It provides a centralized view of outstanding invoices, allowing collection agents to prioritize their efforts and take appropriate actions.

The Collection Agent Screen also enables collection agents to maintain detailed records of interactions with customers regarding overdue payments. This includes recording communication logs (i.e., phone calls, emails, or other forms of correspondence) to keep a comprehensive history of collection activities. These records serve as essential documentation for reference, analysis, and dispute resolution purposes.

Reports in AR

The AR module has numerous reports that provide up-to-date information on all of your AR related activities.

Aging Summary

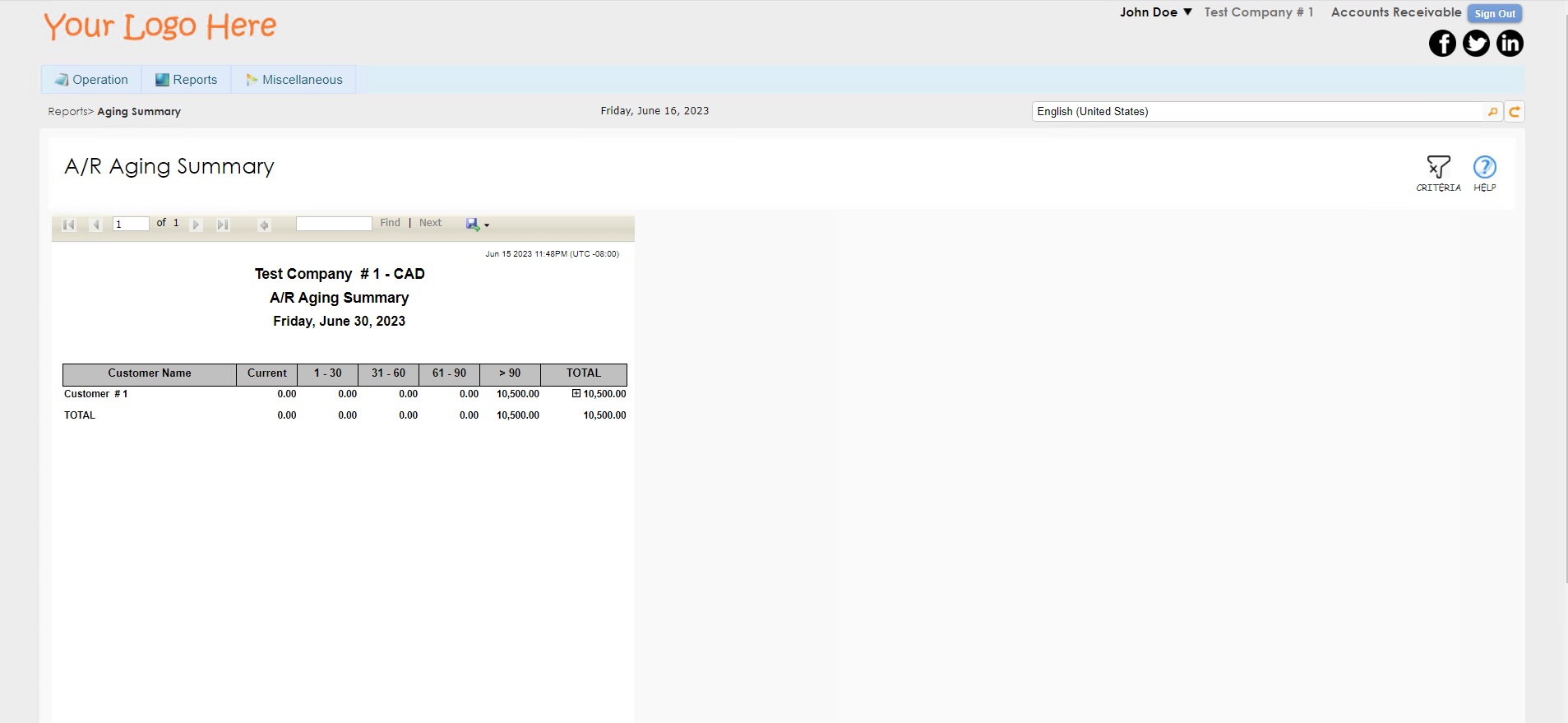

The Aging Summary report provides a concise overview of the outstanding balances owed by customers across different aging periods. This report helps businesses to assess the status of their receivables and gain insights into the aging of their accounts. The Aging Summary report typically includes essential information such as customer names, invoice numbers, invoice amounts, and the corresponding aging period. Transactions and balances are grouped by their due dates into aging categories.

Customer Statement

The Customer Statement report retrieves important information on customers such as invoice details, payment history, credit memos, and any outstanding balances. It provides a clear breakdown of the customer's account activity, enabling businesses to review transactions and reconcile records with the selected customer.