Payroll Canada

Introduction

The Payroll module enables users to streamlines the payroll process and simplify tax compliance by automating payroll calculations, maintaining tax compliance, managing employee data, and providing real-time payroll information. This module generates payroll reports for analysis, compliance, and stakeholder communication.

Note: some minor setup is required to make the Payroll module fully functional.

Set Up Payroll Canada

To set up the Payroll Canada module and the General Ledger Accounts, please watch the 1ERP Initial Setup video. It is recommended to set up the Payroll Journal accounts before using the Payroll Canada module.

Features in Payroll Canada

Payroll Info

Navigation: Payroll Canada -> PayRoll Info

The "Payroll Info" screen captures payroll information for your organization, including the number of pay periods and Canada Pension Plan (CPP) and Employment Insurance (EI) information to be used in calculating payroll deductions.

Salary Tracking

The "Salary Info" screen helps keep track of changes in employee salaries over time. This can include records of starting salaries, raises, promotions, and other adjustments to an employee's compensation. Salary Tracking can also track deductions such as taxes, insurance premiums, and other withholdings.

Using this system, employers can easily calculate payroll and generate reports to maintain accurate dataa and compliance with labor laws. Additionally, members can access their own salary information and monitor earnings and deductions in promoting transparency and trust between the employee and employer.

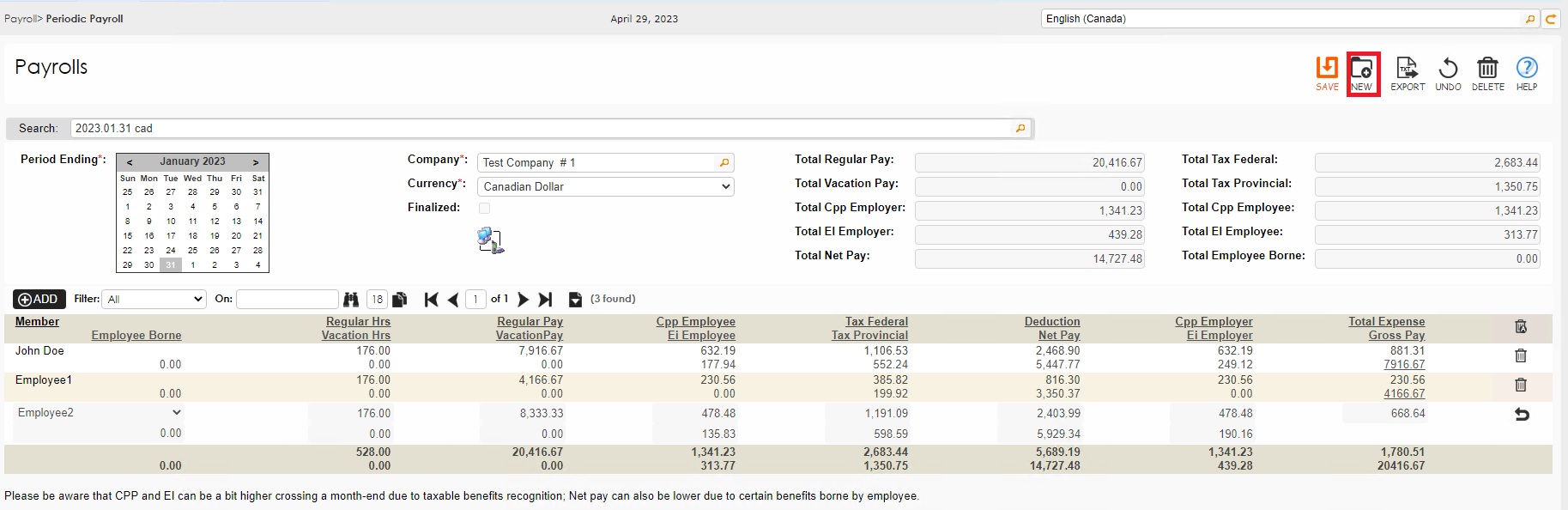

Periodic Payroll

The Periodic Payroll feature simplifies the process of generating payrolls for members of an organization by generating their payroll data. By following the steps below, users can maintain accurate records on payroll and complete the process more efficiently.

Step 1

Click on the "New" button in the "Periodic Payroll" screen to generate a new payroll. This will initiate the system to prepare the next pay period based on the pay and salary tracking information entered into the system.

Step 2

Review the Payroll Information to verify that the data is accurate. Data includes regular pay, vacation pay, CPP and EI for employee calculation, federal and provincial tax calculations, deductions, net pay information, and CPP and EI for employer calculations.

Step 3

Make any necessary adjustments to the payroll information, such as updating employee information or making changes to the payroll calculations.

Once the information updated is as desired, delete the earlier generated payroll and click on NEW to use the updated info to generate a new payroll.

Step 4

Finalize the Payroll by clicking the icon under the "Finalized" checkbox, once the user is satisfied with the payroll information and any needed adjustments. This will save the payroll information into the system and generate pay stubs for each employee.

Benefit Type

The "Benefit Type" screen enables users to define, customize, and manage different types of benefits that are offered to their members and their associated tax implications, including health insurance and retirement savings. By providing clear and concise information about the tax implications, users can make informed decisions on the types of benefits offered to their members and maintain compliance with relevant regulations.

Recurring Benefit

The "Recurring Benefit" screen enables users to manage benefits for individual members in an efficient and convenient manner. Users can easily set up recurring benefits for each emplopyee, such as health insurance and retirement savings. This feature also allows users to enter and edit employee-specific benefit details, including the amounts of the benefit and recurring benefit if borne by the employee. Through this screen, each employee can easily and efficiently receive the benefits they are entitled to and help streamline the benefits management process.

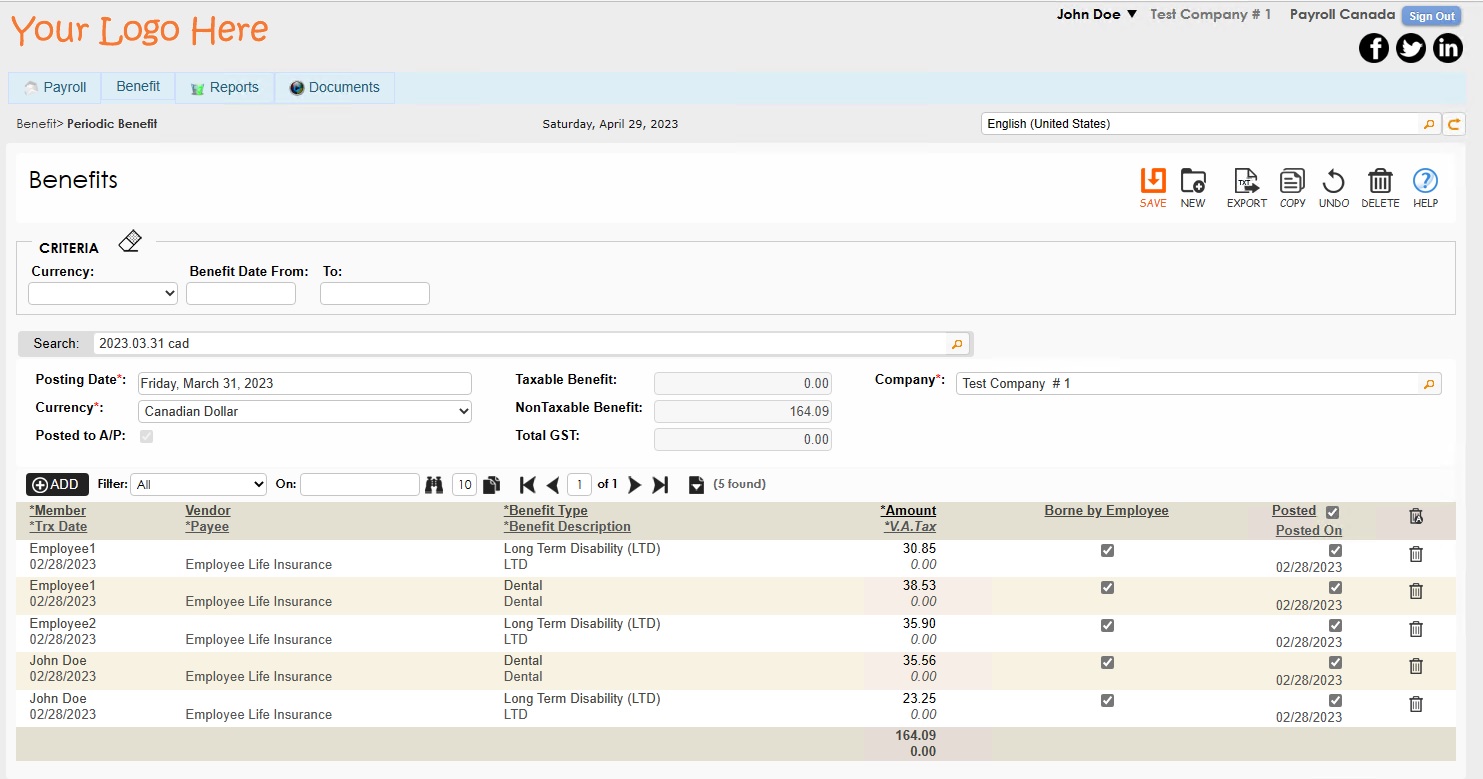

Periodic Benefit

The "Periodic Benefit" screen enables users to enter benefits for their members based on their pay periods as defined in 1ERP. To use this feature:

- Navigate to the "Periodic Benefit" screen and click on the NEW button.

- Enter the posting date, choose the currency, and enter benefit information for the members.

- Click the SAVE button to post the Periodic Benefit to the AP module.

Users can also create copies of previous benefit postings and make any needed changes to use the benefit posting for future periods.

Reports in Payroll Canada

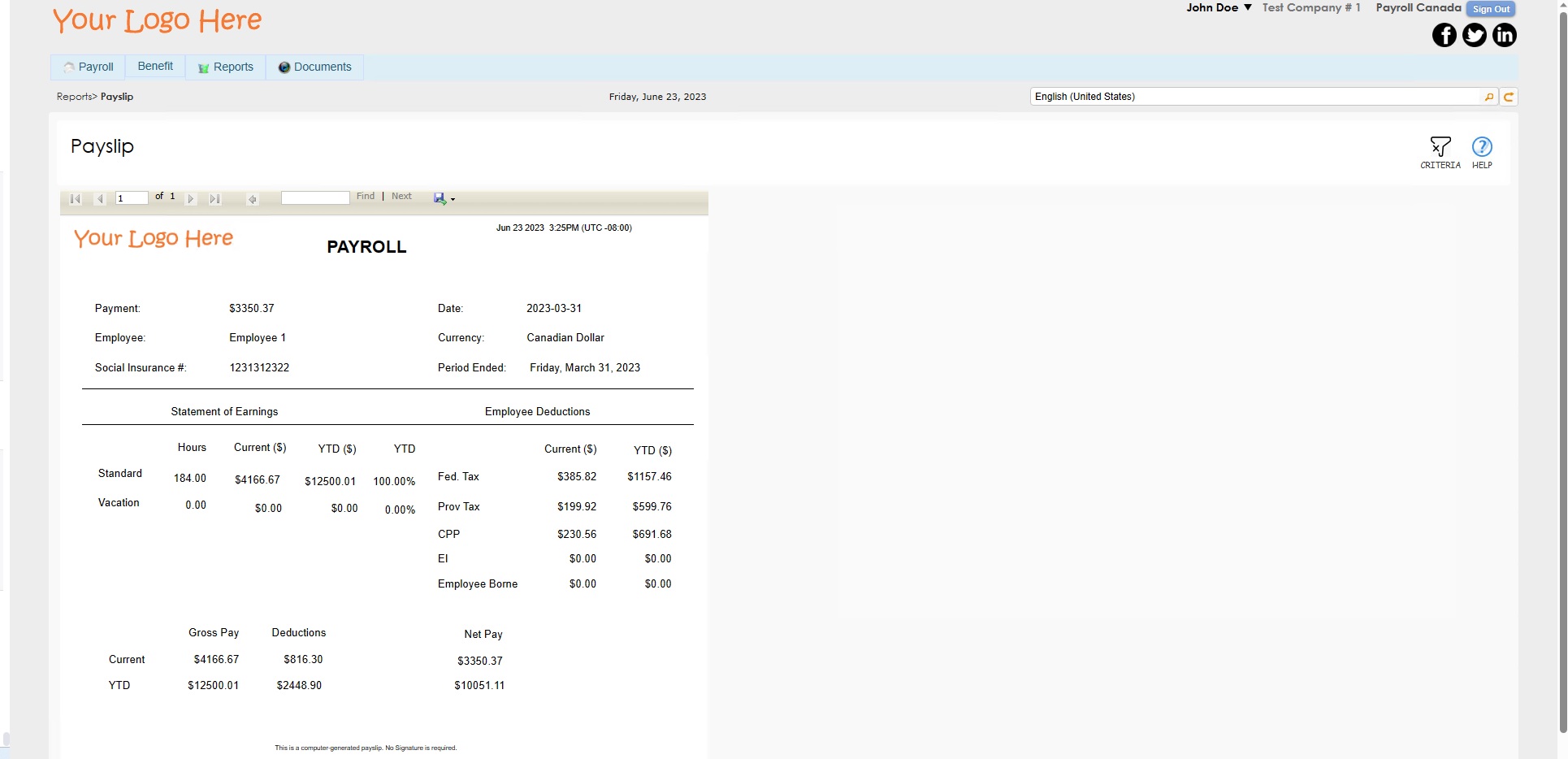

PaySlip

The Payslip report provides a comprehensive summary of employee earnings and deductions for a specific pay period. This includes details such as basic salary, overtime, bonuses, taxes, and net pay. This report is essential for employees to review their earnings and for employers to maintain accurate payroll records.

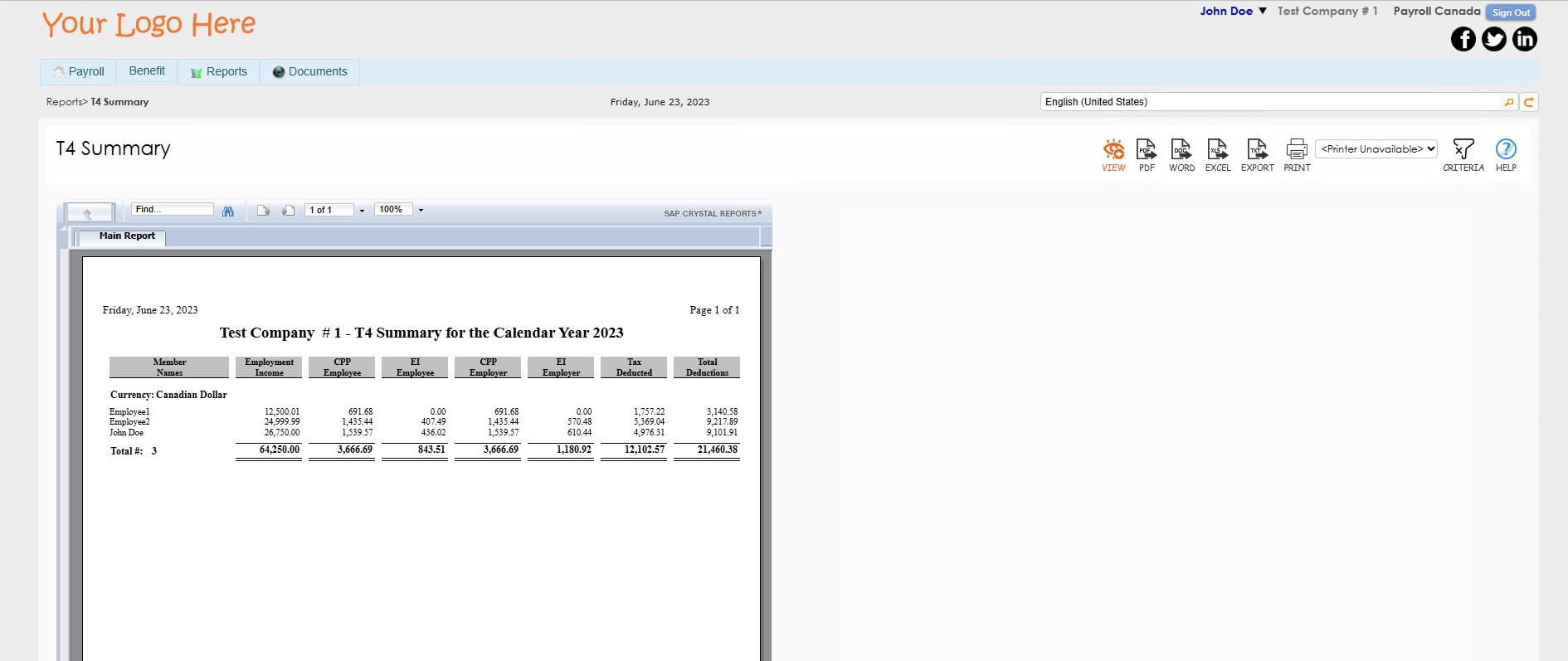

T4 Summary

The T4 Summary report is an important tax document used in Canada for reporting employee income and deductions to Canadian tax authorities. This report summarizes the total earnings, deductions, and taxable benefits for all employees in a given tax year and is an essential tool for employers to accurately file their annual T4 slips and maintain compliance with tax regulations.

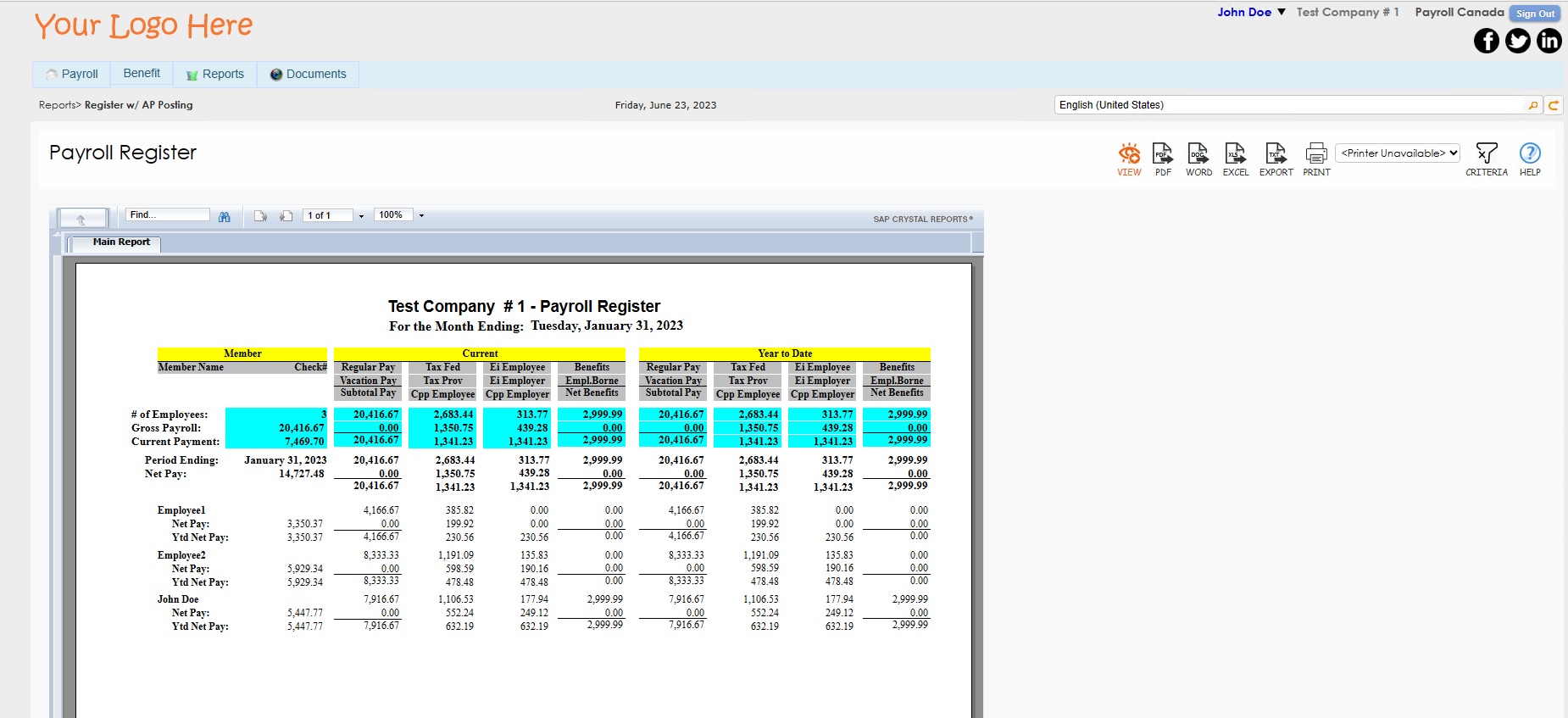

Payroll Register

The Payroll Register report provides a comprehensive overview of payroll transactions for a specific period. This includes details such as employee names, earnings, deductions, taxes, and net pay. This report is valuable for reviewing and verifying payroll information, tracking expenses, and maintaining accurate payroll records for purposes such as auditing and financial analysis.